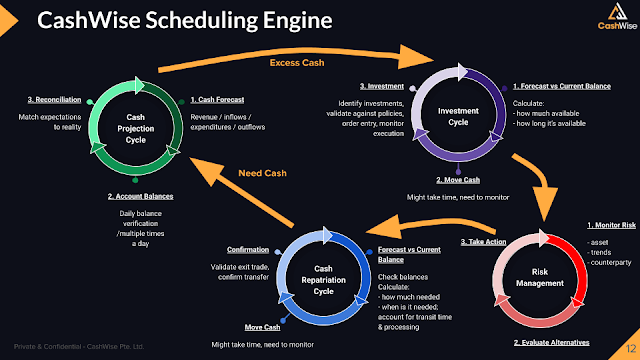

CashWise Cash Movement Process

Intro

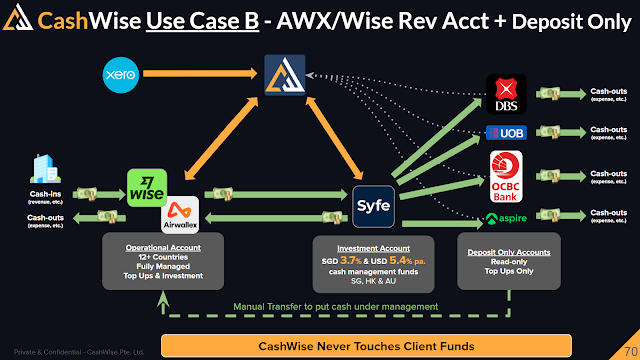

CashWise robo-treasury provides the technology to help businesses simplify and automate their treasury operations to reduce time and errors when managing their cash positions while generating exceptional returns. We are not a bank, however, our delivery partners are licensed companies under MAS (Monetary Authority of Singapore). Third-party service providers that interconnect with CashWise include:

- Airwallex - a MAS licensed Major Payment Institution

- Wise - a MAS licensed Major Payment Institution and a Capital Markets Service Licensee

- Syfe - an investment and fund management company with Capital Markets Service License and is an exempt Financial Advisor under MAS

- Xero - an online accounting software provider

As shown in image 1, the CashWise instruction processes are in the boxes of "What we know", "What We Monitor" and "What We Do" and the cash movements between Airwallex, Wise (Transactional Accounts) and Syfe (Investment Accounts) are highlighted in Green.

CashWise Automation Process

Step 1 - Define the Cash Flows & Policies

Customer establishes the operational policies for each account on the CashWise platform, see . This will include the defining of the target minimum cash balances to maintain and expected cash outflows from transactional accounts over the upcoming few months. This information is used to calculate the idle cash amount and the length of time it will be idle. See additional FAQs:

Step 2 - Daily Operations & Monitoring

During regular operations, Clients will deposit/withdraw and consume cash in the transactional account and CashWise will monitor its balance. In the event the balance deviates beyond target balance plus/minus the minimum transfer amount, CashWise will provide automated instructions to the account providers to either:

- invest excess cash by moving it from transactional account to the investment account; or

- repatriate cash by moving it from the investment to transactional account.

CashWise is a dynamic system, meaning that unforeseen changes in the transactional account balance due to excess spending and/or early revenue receipt are accommodated without the need for human inputs and CashWise will continue to work 24x7x365.

Taking into account the operational policies and cash flow inputs, the CashWise Scheduling Engine will calculate actions needed to maintain the target balance and update the Scheduled Transactions to the Automation tab. The engine ensures liquidity is always available to meet payables as defined by the customer and the maximum amount of cash is deployed to earn interest.

Step 3 - Automation of Cash Movements

CashWise automatically moves funds between customer accounts and is fully aware of cash transit times between accounts, market order execution timing and weekends & holidays. This means that the Scheduling Engine at CashWise is intelligent enough to know when it is optimal to move or not move funds. CashWise is always aware of the exact amount and time duration for which the cash will be left unused. The solution can work for both long term and short-term idle cash scenarios.

When the CashWise Scheduling Engine predicts that the transactional account will be short of funds to make a payable, it will schedule a transaction in advance to liquidate some investments and repatriate funds to the transactional account before the payment needs to occur. As a result, the Scheduling Engine can also predict scenarios when the total future cash position will not be sufficient to provide liquidity for planned cash expenditures and will result in an alert being sent to the Client via email and notified in the Dashboard and Cash Flow pages.

Key points to note - Minimzing Risks

CashWise does not hold your money and/or assets as shown with the Orange lines in the 1st diagram. Instead, your assets are always safe in the custody of our delivery partners which are fully licensed under MAS as shown with the Green lines. Our automated platform minimizes risks by enforcing your policies and continuously monitoring the health of your portfolio.

In Singapore, the SDIC (Singapore Deposit Insurance Corporation Limited) provides protection to depositors in the event of bank failures. The reason this is needed is that the deposits at banks are NOT bankruptcy remote, depositors funds are used by banks to make investments, loans and other transactions to generate income for the bank. In the case where the bank loses money on the investments and the loss is greater than assets of the bank, then depositors' money can and will be lost. SDIC in 2023 only insures deposits up to SGD $75k per bank per depositor. This amount will increase to SGD $100k in 2024. Keep in mind that fixed deposits are also deposits and subject to the same risks as savings and checking accounts.

Using CashWise can help minimize the banking deposit risk by minimizing the amount of deposits with the banks. Automation continuously moves the maximum amount of cash possible into investment accounts which are bankruptcy remote and held with licensed custodians in trust to your company therefore avoiding the entire deposit risk scenario which was witnessed multiple times in history and most recently in the US Silicon Valley Bank failure. Luckily, SVB depositors were made whole by the US government but in reality, only US $250k per account was insured. Even after the US government guaranteed that depositors would get their money back, it still took many weeks for depositors to access their funds. This could have been avoided if funds were held in bankruptcy remote methods, like in an investment account.