What Does the CashWise Scheduling Engine Do?

- Approx time: 07:00

- Task: Update account balances, recalculate automation requirements

- eMail Action: if there are large variances

- Approx time: 09:00

- Task: Update account balances, recalculate automation requirements, send instructions and execute automation

- Most conservative assumption: Always assume that revenue is 100% late, act only on cash in the account.

- Look forward min 2 days & confirm whether enough cash balance is available to cover scheduled cash flow items

- If enough cash, not enough cash anticipated, calculate needs based on current balance and initiate release of cash from investments

- If more cash than target balance and it’s not needed in the next 2 days, move to investment

- Otherwise, no changes needed

- eMail Action: on completion and errors

- Approx time: 16:00

- Task: Update account balances, recalculate automation requirements. You have the opportunity to revise and cancel automations before they are carried out.

- eMail Action: New items and changes

- Approx time: 23:50

- Task: Update EOD account balances, recalculate automation requirements

- eMail Action: if there are large variances

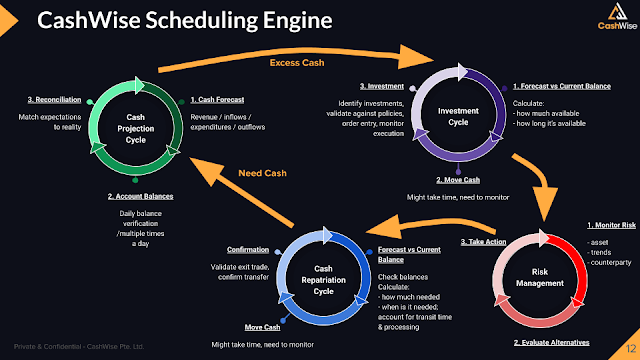

The CashWise Scheduling Engine automatically calculates and schedules fund movements between customer accounts and is fully aware of cash transit times between accounts, market order execution timing and weekends & holidays. This means that the Scheduling Engine at CashWise is intelligent enough to know when it is optimal to move or not move funds. CashWise is always aware of the exact amount and time duration for which the cash will be left unused. The solution can work for both long term and short-term idle cash scenarios.

When the CashWise Scheduling Engine predicts that the transactional account will be short of funds to make a payable, it will schedule a transaction in advance to liquidate some investments and repatriate funds to the transactional account before the payment needs to occur. As a result, the Scheduling Engine can also predict scenarios when the total future cash position will not be sufficient to provide liquidity for planned cash expenditures and will result in an alert being sent to the Client via email and notified in the Dashboard and Cash Flow pages.